2025 showcased the strength of Heartwood Partners’ partnership approach — our equity-rich, lower-debt capital structure and hands-on support enabled portfolio companies to invest in their teams, capabilities, and growth, delivering continued value creation across the portfolio and four successful exits.

4 Exceptional Exits

Heartwood successfully exited M&Q Packaging, MicroCare, and Sur-Seal. In addition, with Amlon, Heartwood Partners completed its first continuation vehicle, which allowed the partnership with the Amlon team to continue. Across each of these four companies, Heartwood Partners strengthened management teams with key hires, made strategic investments in capacity and capabilities, expanded product portfolios, and completed multiple strategic acquisitions. These exits demonstrate how our patient capital and operational support create lasting value.

7 Portfolio Company Add-on Aquisitions

Other Portfolio Company Highlights:

Opened a new, 40k+ sf headquarters and production facility, more than tripling its production capacity and adding a test kitchen.

Expanded VITALSpace’s Baldwin, GA campus by 80k sf to meet increasing demand for its multi-sector, multi-brand modular solutions.

Underwent a rebranding, unifying its subsidiary companies (e.g., Adkins Electric, Millennium Electric) under a single, unified Norlee Group brand. This strategic move aims to present a cohesive identity to the market as an integrated electrical and mechanical service provider throughout the Southeastern U.S. and reflects the operational integration of these businesses.

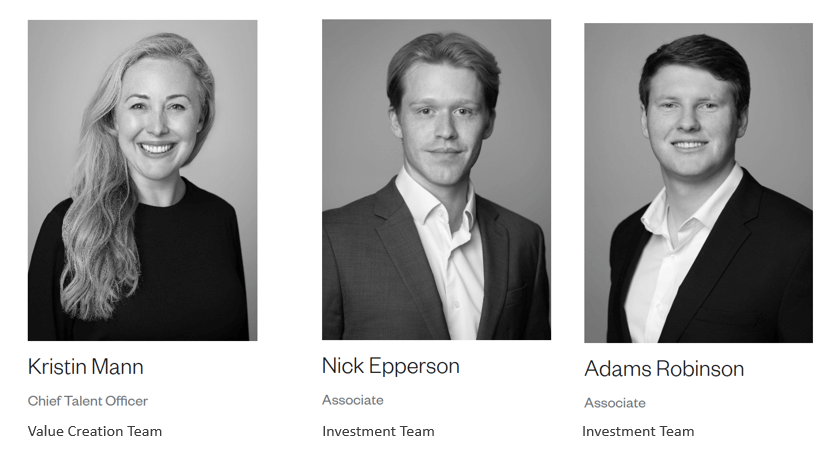

3 Team Additions

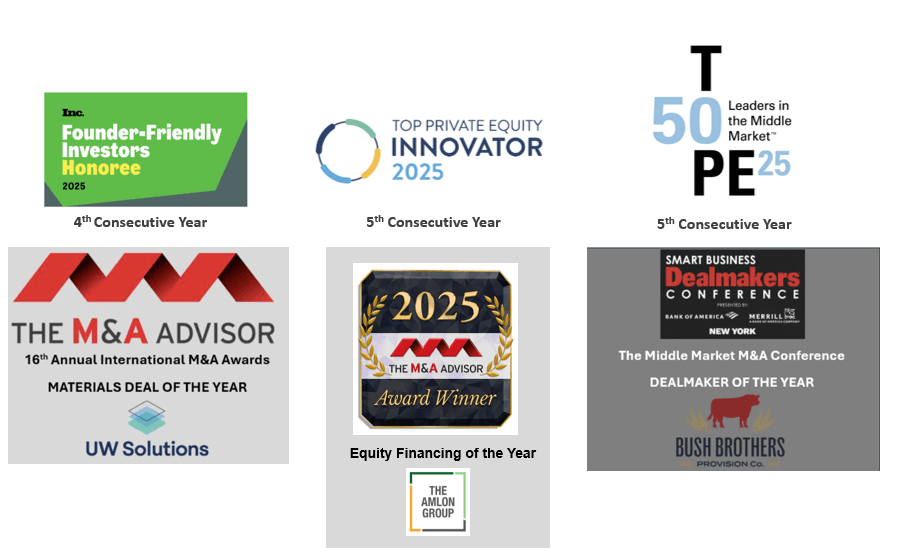

6 Industry Recognitions and Awards:

Please contact the following members of the investment team at Heartwood Partners with investment or add-on opportunities:

John Willert | Partner

jwillert@heartwoodpartners.com

John Newman | Managing Director

jnewman@heartwoodpartners.com