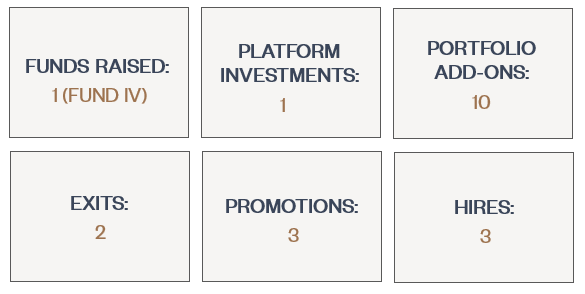

Despite 2023’s high interest rate environment and the resultant challenged operating and leveraged buyout environment, Heartwood’s strength, stability and support found in its value-added resources and lower-debt, equity-rich approach permitted our management teams to stay focused on growing their businesses. Notably, this approach contributed to Heartwood’s ability to close a platform investment in a fifth-generation family-run company, complete ten add-in investments and achieve two successful portfolio company exits. We are also pleased to announce the final close of Heartwood Partners IV, LP. Along the way, we recognized the outstanding performance of three members of our team with well-deserved promotions and added three fantastic new members. We are excited to be well positioned for 2024 with dry powder and a strong portfolio of companies.

Platform Investment:

A fifth-generation family run value-added distributor of premium meat products to a “high-end” foodservice customer base throughout Florida and the Caribbean.

Add-on Acquisitions Closed in 2023:

- Artisant Lane acquired a furniture frame manufacturing company (to be announced)

- Chromascape acquired the Colorants Dye Business of Kemira

- Sur-Seal acquired Ameritape

- High Bar Brands acquired Dieters Metal Fabricating

- Microcare acquired Infection Control Technologies

- Patten Seed acquired All Green Outdoor Center

- The Amlon Group acquired Music City Group and Paragon

- Somafina acquired a nutraceutical contract manufacturer (to be announced)

- NativeSeed Group acquired a Midwest conservation and ag seed business (to be announced)

Platform Exits:

Supplier of custom plastic and magnesium molded parts to the automotive, aerospace, medical and industrial markets.

Preferred solutions provider to the commercial vehicle industry with our family of iconic brands including Minimizer, Premier Manufacturing, and Viking Sales. Products include fenders, floor mats, tool boxes, mud flaps, trailer couplings, jacks and accessories.

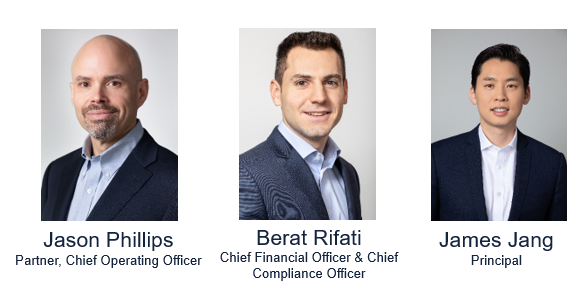

Promotions:

Recognition & Awards in 2023:

Heartwood Partners Supporting Growth, Creating Value:

Lower-Debt, Equity Rich Approach:

- 70% average equity capitalization

- True partnership and cash distributions on seller rollover

- Flexible investment time horizon

Value-Creation Resources:

- Strategy and acquisition support: internal Heartwood team plus 1-2industry-specific independent directors per company

Investment Strategy and Criteria:

Control equity investments in private U.S. companies that fit the following criteria:

- Revenues between $20 million and $250 million

- EBITDA between $5 million and $30 million

- Competitive position with ability to maintain margins

- Solid, committed management team

- Demonstrated ability to produce excess cash flow

- Manageable customer concentration

- S Corporations, LLC’s, partnerships or divisions of larger companies are preferred

- Particular areas of interest include: niche manufacturing, specialty chemicals, packaging, food and agriculture, distribution, and industrial and environmental services

Add-On Acquisition Philosophy:

- Collaborate with platform company management

- Add market share, add product lines, diversify customers and/or expand geographically

- Operating profits of $500K of higher